I have not posted anything in a week as I tried a different method to trade that didn't work. I felt that Alphabet (GOOGL) came off of the bottom last Friday and was going up starting Monday. It went up to 1224 and down from there. It didn't go as low as Friday's low of 1204, but did have a nice run up. I decided to hold on my options for a couple of days because I felt that it was going to 1240 and would open higher by 10 on its way.

Tuesday came and it ran up to 1232 and fell from there never to return until today. When it ran up to its peak on Tuesday, the S&P 500 index was about to pass the all time high from January. Alphabet's indicators were at the very top for over a half hour which indicates that it would probably go down. I expected a small drop followed by a push higher. I was wrong. As Tuesday ended, everything fell going into the close with the Trump associates guilty rulings.

On Wednesday Alphabet opened around 1215, ran up to 1226 and fell to 1218 never passing 1223 in the afternoon. I sold my Call Options that I held since Monday for slightly less than I bought them for although the stock price was 10 higher than when I bought the options. This is why I don't like holding options over night and you should expect to have them sold in less than 45 minutes unless holding on to longer dated options.

If I had not been tied up with the Alphabet options I would have taken advantage of lower cost options for stocks that came off of a recent peak that were due to go higher for example:

- Spotify was 194, came down to 185 and today is back above 191.

- Roku was near 60, came down to 55, now back to 62

- Apple was near 218 on Friday, came down to 214, and now back to 216.

Nvidia fell last Friday from the disappointing earnings report due to only receiving $18 million instead of $100 million from crypto currency mining. It tried to recover Friday before falling back to the after hours low of 242. This week it has run up to an all time high of 269. This is a stock that is strong, but streaky. I have tried to trade options on it before with such small success.

Tesla might have turned a corner as "the most shorted stock in the history of the market" according to Elon Musk. The reports of Musk health concerns drove Tesla's stock down from 305 to 283 in premarket trading on Monday. It opened around 290 and finished the day at 308. From there it has moved up to 327, but has stayed around 321. Tesla has positive news for deliveries and negative news about a car hitting an object then catching on fire. This week it is stayed consistent.

Outside the initial movement in the morning, there is not a lot of movement as it appears that the market is waiting for something. Tariff news is increasing with more planned tariffs on China and anticipation for a meeting with the leaders of China to work out a trade agreement. One thing is sure is it could take an hour for a stock to peak and in 20 minutes go back to where it started.

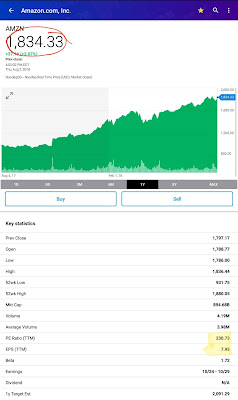

Day trading this market can still make a lot of money as long as you know your stock. Alphabet (GOOGL) typically moves 10 to 12 from the prior close or the morning open. It goes up and down that far. Home Depot, Best Buy and Apple have moved 2 to 4 points in either direction each day. With the stagnate market this feels similar to a type of bear market beginning. As we come to the end of the 2nd quarter earning reports, we might see more of the same. Maybe not as Amazon came close to hitting another all time high this morning.